What Is a Medicare Supplement (Medigap) Plan?

Medicare, Parts A and B, pays for many of your health-care services and supplies, but it doesn’t pay for everything. This is why you may want to consider getting a Medicare Supplement insurance policy, also known as Medigap. A Medigap policy is sold by private insurance companies. These plans pay the hospital and medical costs that Original Medicare doesn’t cover. These include, but are not limited to copayments, coinsurance, and yearly deductibles. Some Medigap policies also help pay for services that Original Medicare doesn’t cover. Essentially, a Medigap policy fills the “gaps” in Original Medicare coverage.

How do Medigap policies work with Medicare?

Medigap policies supplement your Medicare benefits, which is why these policies are also called Medicare Supplement plans. If you have Original Medicare and a Medigap policy, Medicare will pay first, as your primary insurance, and your Medigap policy will fill in the cost gaps. For example, suppose you have a $5,000 ambulance bill and have not yet met the yearly Medicare Part B deductible. Medicare Part B will pay 80% of your ambulance bill, minus the deductible amount. The Medigap policy would then pay your remaining 20% coinsurance of your $5,000 ambulance bill. Some Medigap policies also pay the remainder of the Medicare Part B deductible you still owe.

Plans that don’t supplement Medicare coverage are not Medigap policies)

It’s important to be aware of which plans are not supplements to your Original Medicare:

- Medicare Advantage plans (like an HMO or PPO)

- Medicare prescription drug plans (Part D)

- Medicaid

- Employer’s or union’s plans

- TRICARE

- Veterans’ benefits

- Long-term care insurance policies

What benefits do Medigap policies cover?

Currently, there are 10 standardized Medigap plans, each represented by a letter (A, B, C, D, F, G, K, L, M, N; there’s also a high-deductible Plan F). These are sold in most states (Massachusetts, Minnesota, and Wisconsin each have their own different set of Medicare supplement plans). Coverage levels and premiums vary, but the benefits of each plan within a lettered category remain the same despite the insurance company or location. For example, Plan A benefits are the same in New Jersey as they are in Oregon.

In general, Medigap policies cover the following benefits:

- Medicare Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used)

- Medicare Part B coinsurance or copayment*

- Blood (first 3 pints)*

- Part A hospice care coinsurance or copayment*

*Coverage may be partial for some plans

Some types of Medigap policies also cover:

- Skilled nursing facility care coinsurance

- Medicare Part A deductible

- Medicare Part B deductible

- Medicare Part B excess charges

- Foreign travel emergency

What benefits are not covered by Medigap policies?

Medigap policies don’t cover the following health services and supplies:

- Long-term care (care in a nursing home)

- Vision or dental care

- Hearing aids

- Eyeglasses

- Private-duty nursing

- Drugs

When’s the best time to buy a Medigap policy?

The best time to buy a Medigap policy is during your Medigap Open Enrollment Period. This period lasts for 13 months and begins on the first day of the month in which you’re both 65 or older and enrolled in Medicare Part B. Some states have additional Open Enrollment Periods including those for people under 65. During this period, an insurance company cannot use medical underwriting. This means the insurance company cannot do any of these because of your health problems:

- Refuse to sell you any Medigap policy it offers

- Charge you more for a Medigap policy than they charge someone with no

health problems - Make you wait for coverage to start (except as explained below)

While the insurance company can’t make you wait for your coverage to start, it may be able to make you wait for coverage related to a pre-existing condition. A pre-existing condition is a health problem you have before the date a new insurance policy starts. In some cases, the Medigap insurance company can refuse to cover your out-of-pocket costs for these pre-existing health problems for up to 6 months. This is called a “pre-existing condition waiting period.” After 6 months, the Medigap policy will cover the pre-existing condition.

Additional facts about Medigap policies

- You must have Medicare Part Aand Part B to get a Medigap policy.

- Every Medigap policy must be clearly identified as “Medicare Supplement Insurance.”

- A Medigap policy can only cover one person, so if you are married, you and your spouse would need to buy separate policies.

- Not all types of Medigap policies may be available in your state.

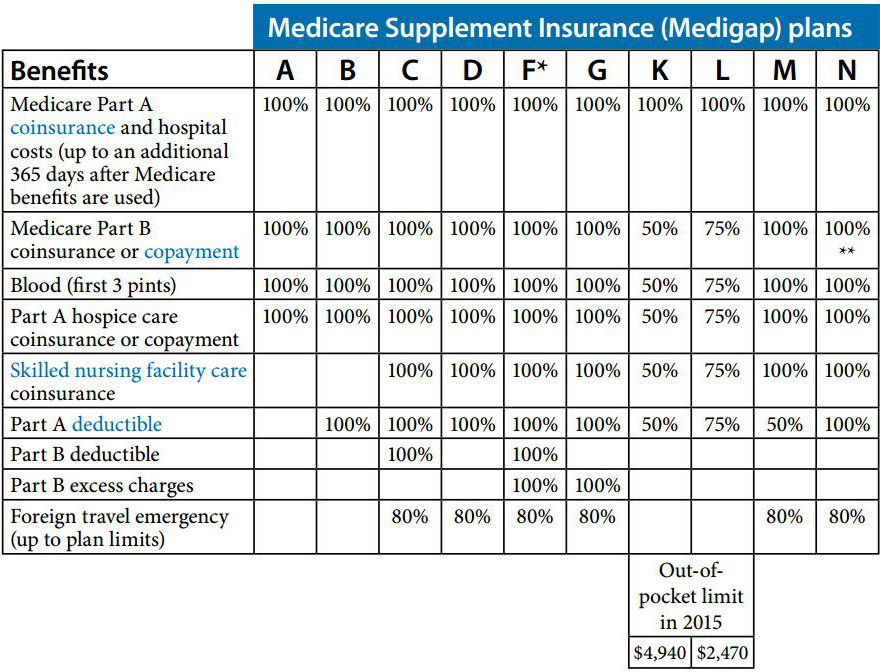

Medicare Supplement (Medigap) Plan Comparison Chart

The 10 different Medicare Supplement (Medigap) plans have standardized benefits across each plan letter. For example, Medigap Plan A will have the same benefits regardless of which state you live in or which insurance company you buy from. If you live in Massachusetts, Minnesota, or Wisconsin, the Medigap plans in these states are standardized differently.

How to read the chart:

If “100%” appears in a row on this chart, the Medigap policy covers 100% of the benefit. If a row lists a percentage, the Medicare Supplement policy covers that percentage of the benefit. If a blank space appears in a row, the policy doesn’t cover that benefit.

*Plan F is also available in a high-deductible version.

**Plan N pays 100% of the Medicare Part B coinsurance. There are a few exceptions: Certain office visits may require a copayment of up to $20; and emergency room visits that don’t result in your being admitted as an inpatient may require a copayment of up to $50.

***Once you have reached the annual out-of-pocket spending limit and your Medicare Part B deductible, your Medigap plan pays 100% for Medicare-covered costs for the remainder of the calendar year.

Please keep in mind that because Medigap benefits are standardized, the main difference between plans of the same type is the cost.

Call a UIA licensed insurance agents at 1-888-725-7955, Monday through Friday, 10AM to 7PM EST